Plant-Based Yogurt Is the Category to Watch in 2020 and Beyond

If you have been paying close attention to the evolution of the plant-based foods industry, you may know by now that the first wave of retail growth began with plant-based milks.

While White Wave’s Silk soy milk wasn’t the first soy milk brand in the United States, they truly kick-started the mainstream crossover trend. Way back in 1996, Silk decided to take their products out of the dusty healthy food aisle, put them in gable-top cartons that looked like milk cartons and sold them in the refrigerated dairy case. Not only did Silk’s soy milk sales surge as a result of this move, but it also paved the way for a plethora of plant-based milks to enter into the grocery carts of mainstream supermarket shoppers in the decades ahead.

Today, there isn’t a nut, seed, grain or legume that hasn’t been turned into a milk, as 48 percent of U.S. consumers buy plant-based milks and these products comprise 14 percent of total milk sales.

While plant-based milk sales continue to rise, lately all the attention has been on plant-based meats. Following a similar playbook as Silk (at least when it comes to placement in grocery stores), in 2016 (20 years after Silk’s bold move), Beyond Meat launched the Beyond Burger in the meat case at Whole Foods Market on Pearl Street in Boulder, Colorado. And the rest, as they say, is history. This year, Beyond Meat went public and along with their competitor, Impossible Foods, have managed to make their way into fast food chains across the nation and in the process, are rewriting the story of what Americans think meat is.

The Bigger Story

As interesting as these sub-plots are, the bigger story is the plant-based foods category as a whole is growing rapidly, and by no means is this movement limited to the meat case or the dairy aisle.

This isn’t just speculation. We now have brand new data from SPINS, commissioned by the Plant Based Foods Association and the Good Food Institute that underscores this point. According to the data, U.S. retail sales of plant-based foods grew 11.4 percent in the past year, bringing the total plant-based market value to $5 billion.

Plant-Based Meats and Milk Continue to Rise

If you dig deeper into the sub-categories of data, plant-based meats have some pretty impressive numbers. The plant-based meat category alone is worth more than $939 million, with sales up 18 percent in the past year. Plant-based meat now accounts for 2 percent of retail packaged meat sales.

Sales of plant-based milks grew 5 percent over the past year, now making up 14 percent of the entire milk category. Meanwhile, cow’s milk sales are nearly flat.

The Emerging Categories

Here’s where the story starts to shape up even better, because it is proof that the rising tide of plant-based foods – lead by meat and milks – is indeed lifting all boats across the plant-based food spectrum.

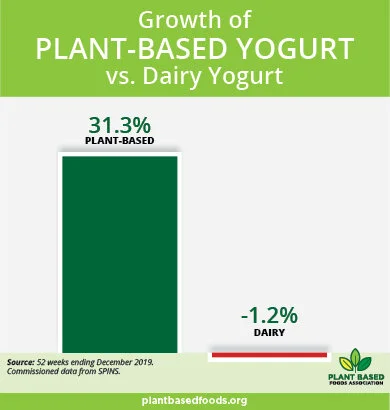

In the past year, plant-based yogurt has grown 31 percent, while conventional yogurt declined 1 percent and plant-based cheese has grown 18 percent, while conventional cheese is flat

The stat that really stands out to me here is plant-based yogurts. Dollar sales of plant-based yogurt grew 31 percent in the past year and the category is now worth $283 million.

That’s some impressive growth for plant-based yogurts, and it says a lot when juxtaposed with the declining dairy yogurt sales. According to experts, the decline is driven by an oversaturated market and changing consumer habits, including the growing trend toward more plant-based foods. As it stands now, after years of explosive growth, U.S. yogurt sales seem destined for the same fate as dairy milk.

While the data above is only focused on the U.S. market, according to a report on the plant-based yogurt market published in April 2018 by Future Market Insights, the global non-dairy yogurt market is predicted to increase by a compounded annual growth rate of 4.9 percent from 2017 to 2027, largely due to the growing number of lactose intolerant people and a growing population of health-conscious millennials who prefer products with low sugar, fat and lactose as well.

The category has also – not surprisingly – witnessed a flood of new brand and product launches such as Hälsa Foods, LAVVA, Ripple, Nancy’s, Califia’s Probiotic Yogurt, Forager’s Cashewgurt, Chobani’s Non-dairy yogurt, Silk’s Almond Milk Yogurt, Kite Hill’s Greek yogurt, Good Karma’s Flax Milk Yogurt, So Delicious’ Coconut Milk yogurt, Danone’s Good Plants yogurt, Daiya’s Yogurt, Follow Your Heart’s yogurts, Yoconut, Cocoyo, Yooga, and many more.

What makes the plant-based yogurt category particularly interesting is that there is no clear frontrunner yet and it appears that the whole space is currently up for grabs.

The Future of Plant-Based Yogurt

While plant-based yogurts are growing, let’s not forget that the overall yogurt pie seems to be shrinking, after a decade of growth. If we want to see truly sustained long-term growth, brands launching products in this category need to expand their imagination and use cases for plant-based yogurt products. Firstly, what is yogurt? Is it breakfast, a snack, or a dessert? The answer is “Yes.” Just being plant-based isn’t going to give you a free pass (at least not for long). Eventually the product has to stand on its own merits against the stiffest of competition and meet the taste, price, and values-expectations of a growing segment of discerning consumers.

Any brand looking to become a contender in this category will have to focus on ensuring their products excel at each and every one of the 10 criteria below.

Allergen-free plant-based base ingredient;

High nutrition (protein, calcium, probiotics);

Low or no sugar;

Clean Label;

Creamy Taste and Texture;

Interesting flavor options;

Flexible packaging/formats;

Environmentally sustainable;

Competitive Price; and

Widespread Availability.

Brands that are able to successfully pull this off stand a good chance of becoming a frontrunner in the crowded race for plant-based yogurt glory. And who knows, perhaps, the growth of plant-based options may bring a new lease of life to an overall declining category?

It is time for yogurt brands to embrace change and evolve, and plant-based may just be the savior the entire yogurt category has been waiting for.