Climbing the Plant-Based Slope of Enlightenment

This is a transcript of Episode #178 of the Eat For The Planet Podcast. Listen to the audio below.

Plant-based food was the next big thing and then it came crashing down. Or did it?

I want to use this episode of the podcast to explore where we are as an industry and what’s next in this space.

A lot has been said and written about the state of the plant-based food industry, specifically plant-based meats off late, and the majority of it has not been positive. The headlines vary but they all essentially say the same thing - plant-based meat was supposed to save the planet and make all its investors richer - but it is failing.

Firstly, the only way I can address this specific issue is to take a step back and make the point that when I think of the plant-based food space, I rarely think of it solely in terms of plant-based meat. Yes, meat is the biggest opportunity, with the world’s meat industry worth a trillion US dollars, but the scope of the challenge is by no means limited to meat alternatives.

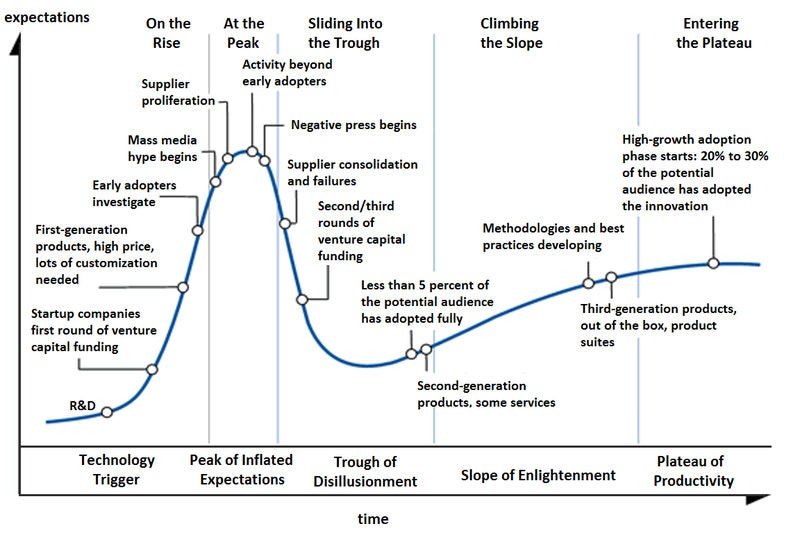

A few different experts have tried to contextualize what’s happening in the plant-based food space with the help of the Gartner Hype Cycle. A good article that makes this link was published in the Financial Times titled “Has the appetite for plant-based meat already peaked?” The common thread here is that many technology innovations, including smartphones, blockchain, and electric vehicles have followed the cycle, and the plant-based food space is no different.

For those that are unfamiliar with it, the The Gartner Hype Cycleis a framework used to understand the adoption and maturity of new technologies, products, or concepts. It was first introduced by the Gartner research firm in 1995, and since then, it has become a widely accepted tool for tracking the progress of innovation.

So how does this relate to plant-based food? Well, driven by new technological innovations and rising consumer demand for sustainable foods, in recent years, plant-based alternatives to meat, eggs, milk, and cheese have emerged as strong contenders to be the foods of the future. Beyond Meat, Impossible Foods, Oatly and several other well-funded and hyped companies have gathered the attention of the press, the food industry, and most importantly consumers. If you look at this space through the lens of the Gartner Hype Cycle you can see that the industry has already gone through the Technology Trigger phase, where a slew of new products across food categories began to enter the market starting in and around 2015. The market has also passed the Peak of Inflated Expectations phase, where hype and excitement around the innovation reached their absolute peak in 2019 with Beyond Meat’s IPO which exceeded all expectations. On its first day of trading, Beyond Meat's stock soared, closing at $65.75 per share, which was a 163% increase from its initial offering price, making it one of the best-performing IPOs in recent history.

Then came the Trough of Disillusionment phase. All the initial excitement and high expectations surrounding these startups started to fade due slower-than-expected consumer adoption rates. The media went from praising the pioneers in the space to pronouncing the industry to be nearing its end, all within a span of 3 years.

Many would argue we are still in this phase - and judging by all the bickering on Linkedin and Twitter, opinions vary on the matter. Some are ready to pronounce plant-based foods and all alternative proteins dead on arrival, while others partially agree that plant-based meat has not delivered on its promise, but cultivated meat which is just around the corner will undoubtedly succeed because it is meat, and a third group of food-tech optimists refuse to entertain the idea that anything is wrong at all.

I’m obviously making generalizations here, but what I want to do today is attempt to look past all these points of view and focus on how we need to really start preparing for the next phase - The Slope of Enlightenment.

But first, I do want to acknowledge the partial truths hidden in the spectrum of narratives active today, by talking about why we even find ourselves in the Trough of Disillusionment, and what we can do to successfully navigate out of it.

As Lisa Feria, CEO and Managing Partner at Stray Dog Capital and former guest on this podcast, recently highlighted during a webinar organized by the publication, Food Navigator in march 2023.

She said “ When money was flooding the space from every fund or angel or anybody who had money…we really lost track of not only what the consumer is looking for, but also who we’re designing products for, what price they are looking for,” and as a result the products were greeted with less exuberance” than companies and investors hoped for - causing the latter to pull back.

That’s a pretty damning quote. What was everyone thinking? How could we lose sight of what consumers really want? And how can we prevent this from getting worse?

Here’s my hot take - I think we are finding a way out of this phase already, but we aren’t talking about it yet. Learning from the experiences of early adopters, new brands are starting to develop a better understanding of where and how new innovations can deliver significant value (and where it will not). For example, companies are creating products that are innovative in new ways, like being nutrient dense and with bold flavors, thereby directly meeting specific consumer needs vs. just showcasing their gimmicky new tech-driven versions of another plant-based burger or chicken nugget.

More importantly, new data from the Plant Based Foods Association (PBFA) confirms this. PBFA recently released their latest Plant Based Foods State of the Marketplace report. I’m going to read something from from the blog post summarizing this report titled “The Story of Plant-Based Foods in 2022: Resilience, Growth Trends, and Engaged Consumers.”

Coming off a year of rising inflation rates and continued supply network disruptions, plant-based foods have faced a rocky landscape. Consumers became more price-conscious and companies continued to adapt and innovate to bolster their ingredient sourcing or secure funding. 2022 also saw growing scrutiny for the plant-based foods industry and speculation around whether the future for our nascent industry was as strong as initially predicted. With all of these dynamics and considerations in the backdrop, the news is actually very good.

Wait a minute, did they just say the news is good? Yes, according to the PBFA, the top line takeaway from the report findings is: Consumer demand for plant-based food is strong and the sales performance of plant-based foods outpaced all speculation, demonstrating the utmost resiliency.

But where’s the proof of that? Well, obviously I’d recommend you read the report but I’ll just highlight 3 stats to illustrate why this is true across 2022 retail and e-commerce sales and foodservice performance.

Stat #1 - Plant-based food dollar sales grew 6.6% in 2022 to $8 billion.

Stat #2 - Plant-based foods captured 6.4% of total online sales, compared to a 4.5% share in grocery retail.

Stat #3 - 48% of restaurants across the U.S. feature plant-based foods on their menus.

So now that we know all hope is not lost, how can we continue this growth as we climb the slope of enlightenment? I’ve identified some areas companies should focus on to increase the visibility and appeal of their products to a wider range of consumers.

I’ve divided this into 3 pillars : The first is Innovation, the second pillar is Accessibility, and the final pillar is Sustainability.

Pillar #1: Innovation

Here’s what needs to happen on the innovation front. Firstly, we need to address nutritional concerns. We have to accept that some consumers may be hesitant to switch to plant-based alternatives. Thus could be due to concerns about the products containing a combination of various unfamiliar ingredients to replicate the taste and texture of their animal-based counterparts. Companies must prioritize addressing these issues head on by not only ensuring they mimic animal products, but also deliver when it comes to nutrient density and consumer preferences around clean labels. This can go a long way in alleviating consumer concern around plant-based food products and their health and will help build consumer trust. The second area of focus under the innovation pillar is global flavors. As I said earlier, merely making a good plant-based burger or chicken nugget is no longer good enough. Brands in this space need to diversify their offerings by meeting consumer demand for taste and formats replicating popular dishes from various cuisines around the globe. This will not only be in keeping with evolving food trends, but will also provide consumers with a wider variety of plant-based meal options and help expand the market reach of products in the space.

Pillar #2: Accessibility

Now let’s dive into the second pillar of accessibility. The first thing companies can do here is have a bigger focus on foodservice. Why? Because the industry has a trust and reach problem. This is why foodservice can be a significant lever for growth and expansion. Foodservice has an unfair advantage because it is more accessible. Here plant-based products are presented in a familiar environment and context, which reduces the barrier to trial. In a food service environment professional cooks get to showcase the products in the way they are intended to meet the needs and specific taste of their diners. This helps drive consumer trial in a convenient way and can go a long way in making a great first impression about their products and can change any preconceived notions diners have of the taste and texture, as well as uses of the products. The second area companies in this space can focus is Prepared Frozen Meals. This is because the demand for convenient, ready-to-eat plant-based options is on the rise. These meals cater to busy consumers seeking healthy and tasty plant-based options without spending much time in the kitchen, making plant-based eating more accessible and appealing to a wider audience.

Pillar #3: Sustainability

The last pillar is sustainability, which unlike the first two is a more long term bet, rather than a short-term concern. The reason i include it here is because sustainability is one of the unfair advantages of plant-based products and companies in this space need to dive deeper into it, rather than assume that consumers will accept their products because plant-based agriculture is somehow inherently more sustainable than animal-based agriculture. So what do companies have to do here? Be committed to and emphasize sustainable sourcing of ingredients and use of regenerative agriculture practices. We have to prioritize working with farmers and suppliers that adopt practices aimed at improving soil health, reducing water usage, and promoting biodiversity to minimize the environmental impact of the products. If we truly want to transform the food system this is non-negotiable. Secondly, while this might be the early days of this trend, as the industry matures, there has to be an increased focus on sustainability beyond the ingredients themselves. Sustainable packaging and sustainable sourcing practice across all areas of a company’s supply chain are going to be table stakes.

So those are my 3 pillars or areas of focus that can get us climbing up the slope of enlightenment in the plant-based food industry.

I’ll close this out by saying that there’s one more area we can not lose sight of - and this might be an obvious one – but it bears repeating. In addition to being committed to meeting the needs of consumers and delivering on health and sustainability promises, we have to be committed to changing public perceptions around plant-based food. Many people are still not aware of the health and environmental benefits of a plant-based food and the industry needs to focus on educational campaigns and targeted marketing efforts to address this unmet need. Perception becomes reality, so changing the narrative is crucial for the industry’s continued growth.

That’s all I have for this episode. Thank you for listening.